The Stock Market Could Be Setting Up to Disappoint

There could be a massive bubble brewing in the stock market. Beware if you are heavily invested in stocks; major disappointment could be ahead.

What is a bubble? It’s when you see abnormal returns. One could even say that a bubble occurs when asset prices double in value much faster than the historical average.

You see, over the past few years, certain areas of the stock market have gotten a lot more attention than others. A lot of money has gone there, and those areas are certainly worth watching.

One area of the stock market that investors should pay close attention to is technology stocks. There could be a bubble forming.

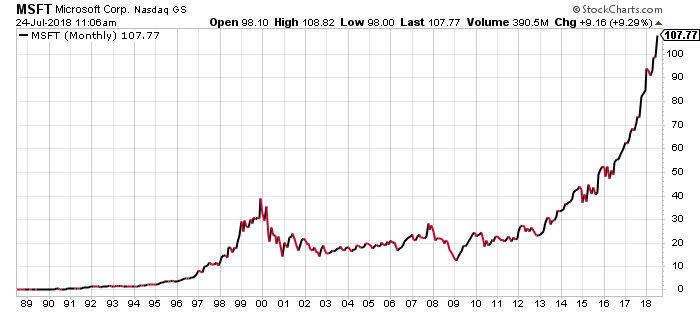

Look at the chart below. It shows the long-term performance of Microsoft Corporation (NASDAQ:MSFT) stock.

Chart courtesy of StockCharts.com

Just look at the rise in the MSFT stock price since 2014. We have seen an almost vertical move to the upside.

Consider this: in dollar terms, you would have been better off holding MSFT stock between 2014 and now than at any other time in the company’s history.

If you had bought MSFT stock in 2001, at a price of around $20.00, you would have doubled your money by around 2014. That’s a 13-year holding period.

If you had bought MSFT stock in 2014, you would have doubled your money by 2017. That’s just three years.

If you had bought it in 2016, you would have doubled your money by early 2018. That’s two years.

See what’s happening?

While we are at it, the last time something like this was happening in the stock market, we were in the midst of what we now know as the dotcom bubble.

It’s Not Just Microsoft Stock Surging…

Understand that Microsoft isn’t the only company that has seen an almost vertical move to the upside over the past few years. Pick any major technology stock, and chances are its stock price has surged.

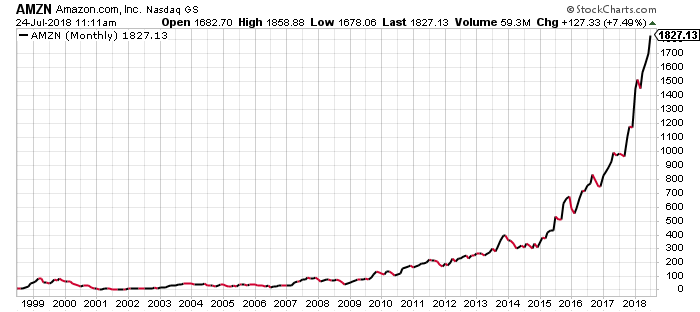

Look at the long-term chart of Amazon.com, Inc. (NASDAQ:AMZN) below.

Chart courtesy of StockCharts.com

With Amazon, we have seen a rapid move to the upside.

In dollar terms, money is being doubled much faster with this company. In 2017, AMZN stock traded at $800.00. Now it’s worth $1,800. Investors doubled their money in a little over one year.

Look at Netflix, Inc. (NASDAQ:NFLX), Alphabet Inc (NASDAQ:GOOG), or Facebook, Inc. (NASDAQ:FB). Investors are doubling their money very quickly as well.

So, Time to Turn Bearish?

Dear reader, let me make this very clear: I am not bearish on technology stocks right now. Even if the bubble is brewing there, trying to predict when it will pop could be a big mistake. Bubbles can go on for a while.

You should also understand that, although bubbles go on for a while, they do not last forever. They eventually pop. When they do, it’s not a pretty sight.

All I am saying is that we are headed in the wrong direction on the stock market. Over the years, I have seen several bubbles form and pop. The price action we see in technology stocks resembles a lot of those bubbles: a rapid move to the upside, significant bullish sentiment, beyond-reasonable expectations, and so on and so forth.

I can’t stress this enough: If technology stocks witness a sell-off, don’t be shocked to see them take the whole stock market down with them.